of a head-to-head battle between a bull (the buyer)

and a bear (the seller). Bulls push prices higher, and

bears lower them. The direction prices actually move

shows who wins the battle

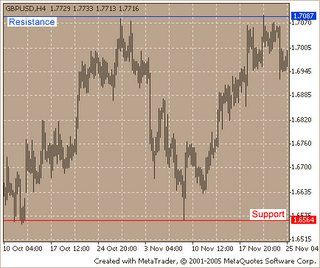

Support is a level at which bulls (i.e., buyers) take control

over the prices and prevent them from falling lower.

Resistance, on the other hand, is the point at which sellers

(bears) take control of prices and prevent them from rising

higher. The price at which a trade takes place is the

price at which a bull and bear agree to do business.

It represents the consensus of their expectations. Support

levels indicate the price where the most of investors

believe that prices will move higher. Resistance levels

indicate the price at which the most of investors feel prices

will move lower. But investor expectations change with

the time, and they often do so abruptly. The development

of support and resistance levels is probably the most

noticeable and reoccurring event on price charts.

The breaking through support/resistance levels can be

triggered by fundamental changes that are above or

below investor's expectations (e.g., changes in earnings,

management,competition, etc.) or by self-fulfilling prophecy

(investors buy as they see prices rise). The cause is not

so significant as the effect: new expectations lead to

new price levels. There are support/resistance levels,

which are more emotional.

Supply and demand

There is nothing mysterious about support and resistance:

it is classic supply and demand. Remembering supply/demand

lines show what the supply and demand will be at a given price.

The supply line shows the quantity (i.e., the number of shares)

that sellers are willing to supply at a given price. When prices

increase, the quantity of sellers also increases as more investors

are willing to sell at these higher prices. The demand line shows

the number of shares that buyers are willing to buy at a given

price.

When prices increase, the quantity of buyers decreases as

fewer investors are willing to buy at higher prices. At any

given price, a supply/demand chart shows how many buyers

and sellers there are. In a free market, these lines are

continually changing. Investor's expectations change, and

so do the prices buyers and sellers feel are acceptable.

A breakout above a resistance level is evidence of an

upward shift in the demand line as more buyers become

willing to buy at higher prices. Similarly, the failure of a

support level shows that the supply line has shifted

downward. The foundation of most technical analysis

tools is rooted in the concept of supply and demand.

Charts of prices for financial instruments give us a superb

view of these forces in action.

Traders’ remorse

After a support/resistance level has been broken through,

it is common for traders to ask temselves about to what

extent new prices represent the facts. For example, after

a breakout above a resistance level, buyers and sellers may

both question the validity of the new price and may decide

to sell. This creates a phenomenon that is referred to as

"traders’ remorse": prices return to a support/resistance

level following a price breakout.

The price action following this remorseful period is crucial.

One of two things can happen: either the consensus of

expectations will be that the new price is not warranted,

in which case prices will move back to their previous level;

or investors will accept the new price, in which case prices

will continue to move in the direction of the breaking through.

In case number one, following traders’ remorse, the consensus of

expectations is that a new higher price is not warranted,

a classic "bull trap" (or false breakout) is created.

For example, the prices broke through a certain resistance

level (luring in a herd of bulls who expected prices to move

higher), and then prices dropped back to below the resistance

level leaving the bulls holding overpriced stock. Similar

sentiment creates a bear trap. Prices drop below a support

level long enough to get the bears to sell (or sell short) and

then bounce back above the support level leaving the bears

out of the market. The other thing that can happen following

traders’ remorse is that investors expectations may change

causing the new price to be accepted. In this case, prices will

continue to move in the direction of the penetration. A good

way to quantify expectations following a breakout is with the

volume associated with the price breakout.

If prices break through the support/resistance level with a

large increase in volume and the traders’ remorse period is

on relatively low volume, it implies that the new expectations

will rule (a minority of investors are remorseful). Conversely,

if the breakout is on moderate volume and the "remorseful"

period is on increased volume, it implies that very few investor

expectations have changed and a return to the original

expectations (i.e., original prices) is warranted.

Resistance becomes support

When a resistance level is successfully broken through,

that level becomes a support level. Similarly, when a

support level is successfully broken through, that level

becomes a resistance level. The reason for it is that a

new "generation" of bulls appears, who refused to buy

when prices were low. Now they are anxious to buy at

any time the prices return to the previous level. Similarly,

when prices drop below a support level, that level often

becomes a resistance level that prices have a difficult

time breaking through. When prices approach the

previous support level, investors seek to limit their

losses by selling.

Happy learning

No comments:

Post a Comment